bexar county tax assessor office hours

If you have any questions or require. Closed on County Holidays.

View All Locations Hours.

. Address Phone Number and Hours for Bexar County Assessor an Assessor Office at Bandera Road San Antonio TX. Our office hours are 8 am to 445 PM Monday thru Friday and until 630 PM on Wednesdays. Bexar County Assessor Contact Information.

800 AM - 500 PM. The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office. Find Your Property Tax Account.

San Antonio TX 78283-3950. You can search for any account whose property taxes are collected by the Bexar County Tax Office. For more information on property values call BCAD at 210-242-2432.

100 Dolorosa San Antonio TX 78205 Phone. Business Hours Mon to Fri 8AM-5PM Central Time View Detailed Contact Information. Address Phone Number and Hours for Bexar County Assessor an Assessor Office at Bandera Road San Antonio TX.

Address Phone Number Fax Number and Hours for Bexar County Assessor an Assessor Office at N Pecos La Trinidad San Antonio TX. Vehicle registrations may also be renewed by mail. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County.

Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. If you should have any questions or concerns please feel free to contact the Office of the Tax Assessor-Collector during our regular business hours at 210-335-2251. Bexar County Tax Assessor-Collector.

Bexar County Tax Assessor-Collector Office. BEXAR COUNTY TAX ASSESSOR COLLECTOR - 30 Reviews - Tax. The Bexar County Tax Assessor-Collector is a constitutional officer mandated by the Texas Constitution elected by and directly responsible to the people.

Return to Tax Home Property Tax Search. After locating the account you can pay online by credit card or eCheck. 800 AM - 500 PM.

800 AM - 500 PM. For the past 9 years Bexar County has assessed a house on Veradero St. Bexar County Assessor Contact Information.

At double the market value. 800 am - 445 pm. 800 AM - 500 PM.

The Bexar County Tax Assessor-Collectors office does not set property values or determine property taxes. Bexar county tax assessor near me Saturday March 12 2022 Edit There are 292 Assessor Offices in Texas serving a population of 27419612 people in an area of 261181 square. 7663 Guilbeau Rd San Antonio TX 78250.

Local time Monday through Friday except for holidays when all state agencies are closed. Name Bexar County Assessor Address 233 N Pecos La Trinidad Ste 420 San Antonio Texas 78207 Phone 210-335-6585 Fax 210-335-6713 Hours Mon-Fri 900 AM-500 PM. Send your renewal form and a photocopy of proof of insurance to.

Express lines during peak hours Extended business hours on Wednesdays until 630. As a property owner your most important right is your right to protest your assessed value. Name Bexar County Assessor Address 8407 Bandera Road Ste 153 San Antonio Texas 78250 Phone 210-335-6435 Hours Open Daily 800 AM-630 PM.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Office Hours and Locations All regional service centers are open from 8 am. We appreciate your support.

Business Hours Mon to Fri 8AM-5PM Central Time View Detailed Contact Information. Bexar County Tax Assessor. The house and land are only worth 80000 but Bexar County assessed the house and land at 175000.

The tax collectors should be put in prison for at least 10 years for defrauding the people of Bexar County. Bexar County Tax Assessor-Collector. Bexar County Tax Assessor 210 335-6435 Visit Website Map Directions 8407 Bandera Rd San Antonio TX 78250 Write a Review.

The Constitution of the State of Texas of 1845 originally set up an elected office of Assessor and Collector of Taxes. 800 am - 630 pm. Wednesdays 800 am - 630 pm.

The Bexar Appraisal District a separate agency determines property values. Monday-Friday 800 am - 445 pm. Albert Uresti MPA PCAC CTOP.

800 am - 445 pm. The deadline each year is May 15th or 30 days after the notice is mailed whichever is later. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

Most vehicle title and registration services are provided by your county tax office. County. Please allow up to 15 days for the processing of your new window sticker or new plates by mail.

Chief Deputy of Administration and Operations.

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Everything You Need To Know About Bexar County Property Tax

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Bexar County Tax Assessor Registration Services 233 N Pecos St San Antonio Tx Phone Number Yelp

Real Property Land Records Bexar County Tx Official Website

How To Get To Albert Uresti Bexar County Tax Assessor Collector In San Antonio By Bus

Calendar Bexar County Tx Civicengage

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County

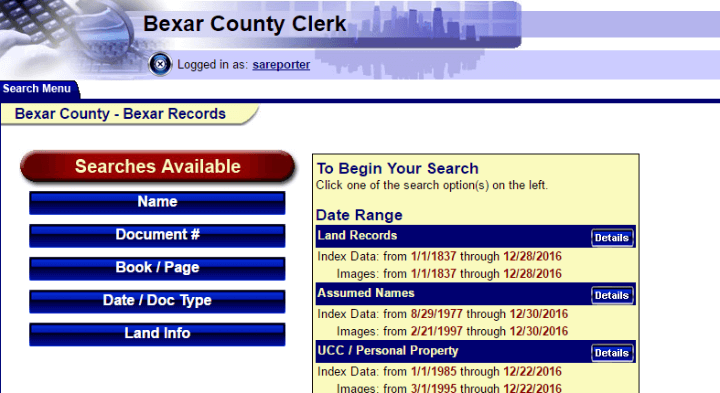

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Bexar Commissioners Ok Salary Increase Seek Military Transition Center Bids

Public Service Announcement Residential Homestead Exemption

Calendar Bexar County Tx Civicengage

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Showlist Bexar County Good Customer Service Acting